New Membership

Do you live in AZ, CA, MA, MD, ME, NH, NV, or VA? Perfect - that's exactly where we offer new accounts.

We are required by Federal law to obtain, verify, and record information that identifies each person who opens an account. You will need the following to complete the application:

- First and Last Name

- Date of Birth

- Social Security Number or Tax Identification Number

- Unexpired US Government issued ID/Driver's License/State ID or US Passport

- Physical Street Address and Mailing Address

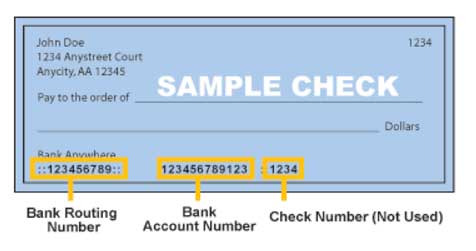

You will also need your current checking account information to fund your new account.

IMPORTANT: If you fund your new Logix Account(s) via ACH Deposit, the date of the deposit will be the date that the ACH deposit is received by us, which may be a date later (typically one or two business days) than the date you opened your Logix Account(s) online. If you open and fund a new Certificate Account online via ACH Deposit, the Certificate opening date the ("Date of Issuance") will reflect the date we receive the ACH funding deposit, and your Certificate Maturity Date will be advanced to correspond to the Term of your Certificate. We will honor the Dividend Rate applicable to your new Certificate as of the day you opened the Certificate online. Dividends are earned on your Logix Accounts beginning on the date the ACH funding deposit is received by us.

- Competitive dividends

- Deposit $5 or more to open your Main Savings account and establish your account

- Federally insured

APY: 0.25% Min Deposit: $5.00

- Open an additional savings account to save for extra unplanned expenses, taxes or any other purpose

- No minimum opening deposit or balance requirement

- Ability to set up automatic deposits and even add a unique nickname

Max APY: 0.25% Min Deposit: $0.00

- Open with $25,000.00 or more

- Dividends earned daily and compounded monthly (on balances of $25,000 or more)

- Dividend Rates are Tiered & Variable:

- Tier 1 Rate earned on balances from $0 - $100,000.00

- Tier 2 Rate earned on balances from $100,000.01 and above

- Enjoy unlimited deposits and withdrawals

Max APY: 3.75% Min Deposit: $25,000.00

APY: 0.00% Min Deposit: $25.00

- Select this product if the primary applicant is 18-24 years old

- Monthly service charge waived with eStatements

- Enjoy "Silver" tier Relationship Rewards benefits

APY: 0.00% Min Deposit: $25.00

- Offers higher yields than a traditional savings account

- Tiered dividend structure ensures the more money you keep on deposit, the more you'll earn

- Make deposits anytime, as well as a limited number of penalty-free withdrawals

- Write up to six checks per month

Max APY: 2.20% Min Deposit: $2,500.00

APY: 3.30% Min Deposit: $1,000.00

APY: 3.30% Min Deposit: $5,000.00

APY: 3.45% Min Deposit: $1,000.00

APY: 4.00% Min Deposit: $1,000.00

APY: 3.45% Min Deposit: $1,000.00

APY: 3.45% Min Deposit: $1,000.00

APY: 3.55% Min Deposit: $100,000.00

APY: 3.55% Min Deposit: $100,000.00

APY: 3.55% Min Deposit: $100,000.00

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

Please upload an image of your Government Issued Photo ID (PDF format)

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

Please upload an image of your Government Issued Photo ID (PDF format)

Beneficiaries Information

Review and Submit

By clicking the “I Agree” button below, I/WE HEREBY make and electronically submit my/our application membership in Logix Federal Credit Union (Logix) and the accounts, products and services I/we have designated. I/We certify that the information provided is true, correct, and complete. I/We consent, understand, and agree that Logix may access my/our credit and account information through any consumer credit reporting agency and/or other account verification service concerning my/our account(s) now and/or in the future, in connection with making future credit offerings, and in connection with this application to establish Logix membership and the requested accounts, products and services. I/We understand that I/we may be asked questions based on the information contained in my/our consumer credit report, the joint accountholder’s consumer credit report, and other consumer account and credit reporting agency databases, as part of this application process so that Logix can authenticate my/our identity and to facilitate the processing of this application. I/we understand and agree that approval of this application and the requested accounts, products, and services is solely at the discretion of Logix Federal Credit Union and is dependent on this process and the review of such information.

Authentication Questions

Application Completed

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as